Happy Friday.

Lets recap the week.

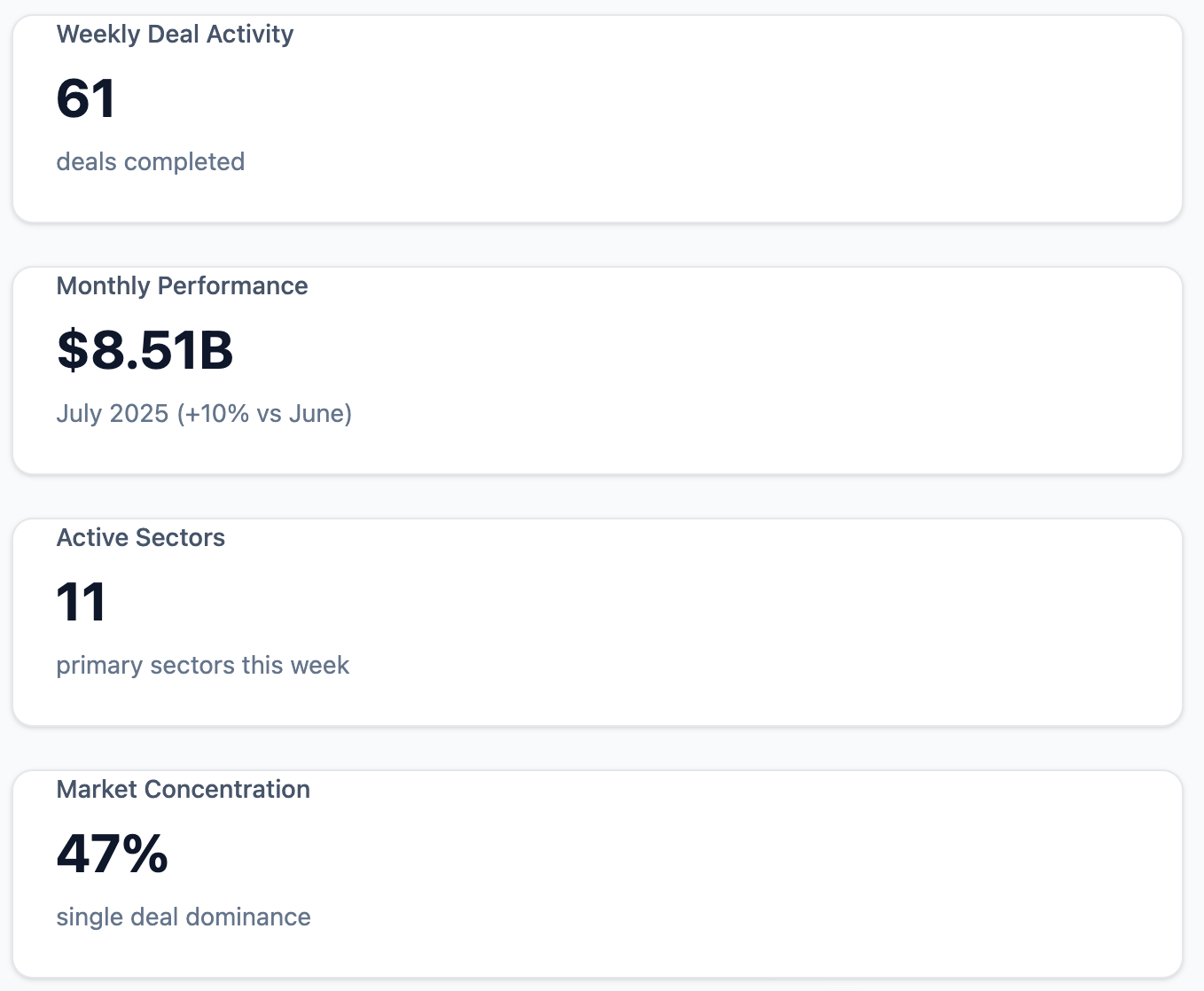

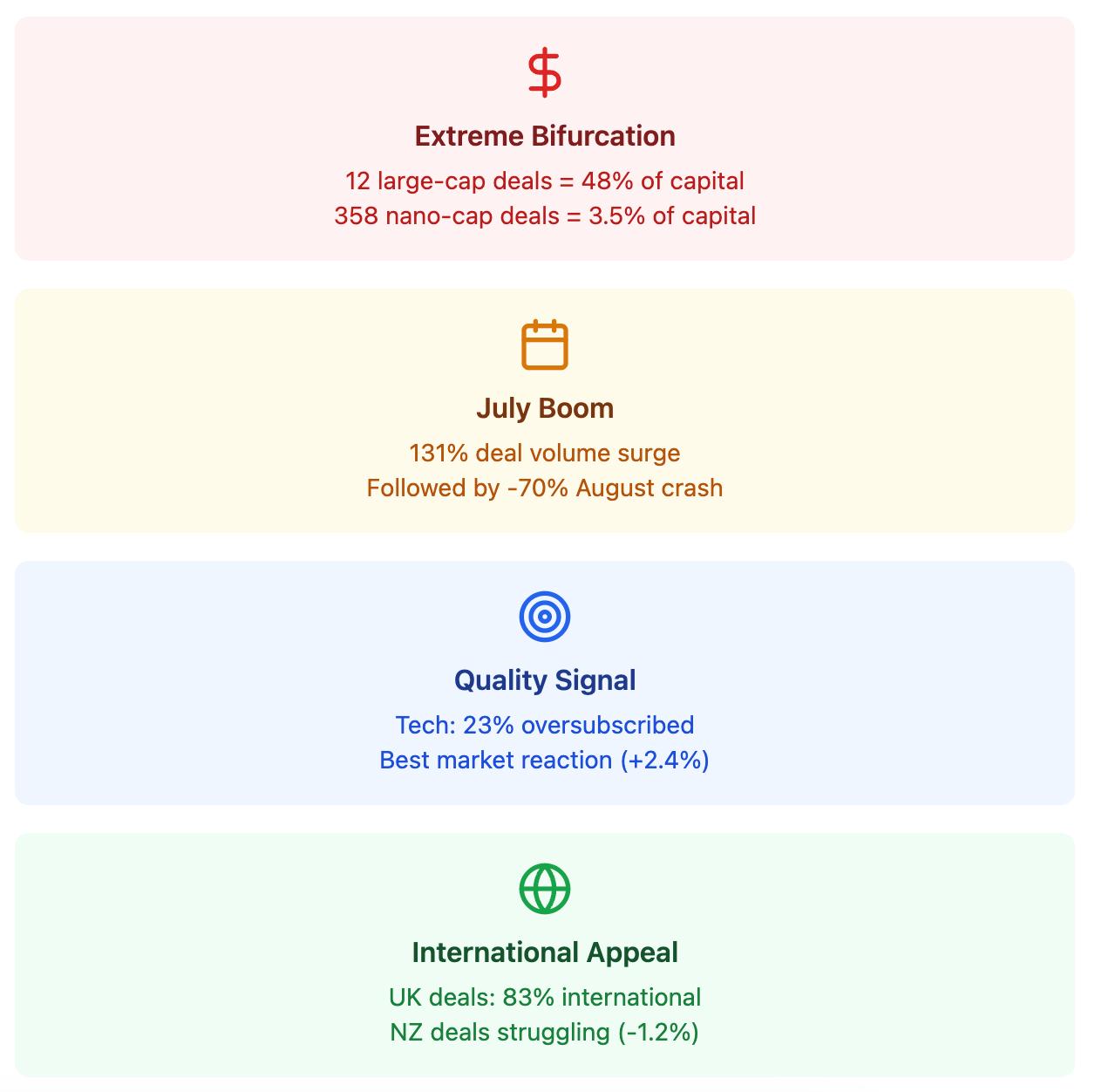

Deals are increasing compared to June, however one mega deal is carrying a lot of this.

We have a similar spread the actual concentration (as one may expect) is a concentration of small cap deals occurring in Mining. Volume is done from last week (however this is largely from 2 or 3 mega deals pushing the average higher).

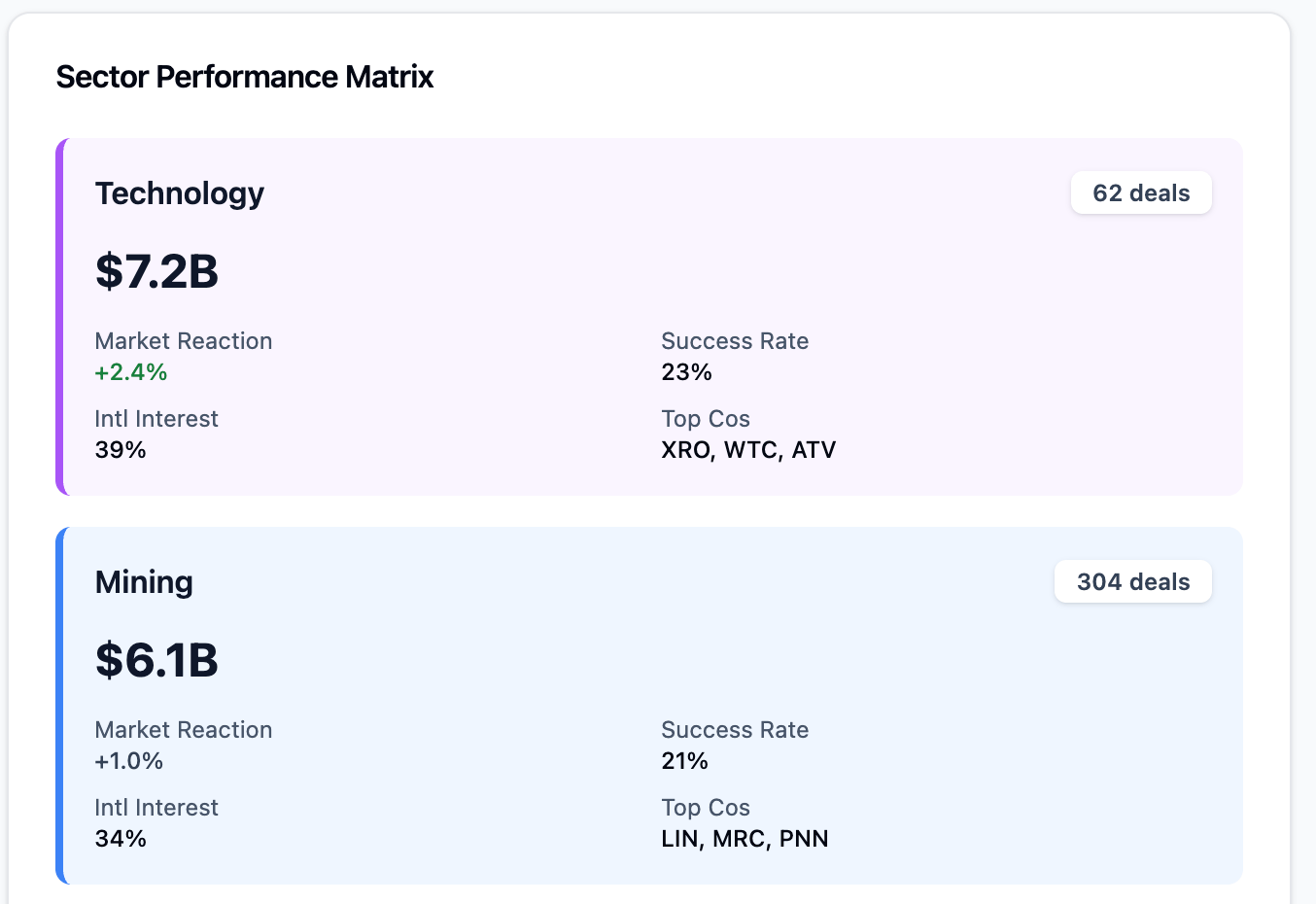

Some more data further showing the above trend. Mining is still getting met with a strong demand with 21% of placements hitting target, however with a more subdued market reaction.

Tech deals are leading the way for over subscriptions and getting received positively by the market. Little old NZ is getting a poor reception despite being an attractive venue for overseas capital.

We have much more additional data and insights available as always reach out if you’d like to know more or get further insights.

Lets get into what happened yesterday.

Profit Guidance Updates

~$3M NPAT

Market Cap: $104.1M 0.0% ●

Period: FY25

Volume Interest: 2.53x (high volume)

$19.9M Revenue

-$7.5M NPAT

Market Cap: $38.6M 0.0% ●

FY25 NPAT: -$7.5M (vs -$5.4M FY24)

Growth: +40.6% revenue growth, but increased losses

Major Capital Raisings

A$266M + A$20M SPP

Market Cap: A$2.05B -1.74% ●

Structure: Fully underwritten placement

Cornerstone: National Reconstruction Fund Corporation (A$50M)

A$130M

Market Cap: A$1.10B +2.21% ●

Volume Interest: 1.5x (above average)

Investors: New high-quality domestic and global institutional investors

Strategic Investments & Smaller Rounds

~A$1.5M

Market Cap: A$16.8M +14.29% ●

Issue Price: A$0.005/share

Bonus: Free attaching options (2:1 ratio)

A$10M + A$3M SPP

Market Cap: A$68.3M -4.35% ●

Strategic Investor: OCJ Investment (Australia) Pty Ltd

M&A Activity: Acquiring Penouta mine in Spain for €5.2M

A$9.5M

Market Cap: A$234.2M +1.07% ●

Structure: Secured, non-convertible, attaching options

Volume Interest: 2.23x (high)

August 8, 2025