Hi hello

Since the last newsletter I’ve been particularly focused with a new position I have started so have not had the time or space to do research for this newsletter.

Where we last left off was trying to reverse engineer the signals that go into creating a multibagger but I would like to announce the focus of it is moving towards tracking Takeover Signals.

tldr: I built a system to detect ASX takeovers before they happen. Across 252 takeover targets and 28,598 signals, it delivers an average of 8 months advance warning and 25.1% average returns across the detection period (it is worth noting this is from first signal not tracking an optimal entry position).

Here's the proof, and here's what it's flagging right now. I’ll be building this out and detailing it in a weekly series and sharing insights from it as well.

Why Takeover Signals?

When I started Capital Signal, I had a simple question: can you extract signal from the noise of ASX announcements?

I tried a few approaches looking for multibaggers, momentum patterns, insider activity. Takeovers grabbed my attention as they're discrete events with clear before/after states. Either someone makes a bid, or they don't. And more importantly tracking the signals is very achievable: accumulation patterns, strategic holders creeping toward thresholds, and multiple buyers circling the same target.

One big one I’ve been watching is Directors sitting on interconnected boards.

The Numbers

Before diving into case studies, here's what the backtest revealed:

252 takeover targets detected (122 schemes, 59 bids, 71 NBIPs)

Note: An NBIP is a "Non-Binding Indicative Proposal." It’s basically a "soft" offer used to test the waters before a formal, legal bid is made.

8.0-month average lead time from first signal to announcement.

12-month average when strategic holders are involved.

The "Golden Window": Signals occurring 90-365 days before a bid deliver a 100.7% mean return.

85.3% of targets had >30 days advance warning.

99.6% detection rate (272 of 273 companies with takeover activity).

That last number took some digging. The system correctly distinguishes between takeover targets (which show accumulation patterns) and acquirers (which show capital raises or no holder movement). For companies with substantial holder filings, we're catching virtually all of them.

The Returns

Theory is nice but returns are really what we are here for. I ran the numbers on 82 targets where we had clean pricing data from signal to bid.

The most important discovery: The presence of Multi-Board Directors (MBD) (directors who sit on 2+ other ASX boards) is the ultimate proxy for a high-premium takeover. The average gain with Multi-Board Directors was +49.8%. The average gain without Multi-Board Directors was -4.9%.

Why the massive difference?

Directors on multiple boards act as human "nodes" for deal flow. They are often brought onto boards specifically because they have the network and M&A experience to facilitate a sale. If a company is loading up on directors who are connected to other major players in the same sector it can be preperation to facilitate an acquisition.

ROI by Signal Type

Not all signals are created equal. Catching a strategic buyer at the right moment is the difference between a multibagger and a loss:

First Signal Type | Avg Gain (%) | Median Gain (%) | Success Profile |

Holder near 20% threshold | +295.8% | +28.9% | STRONG - Catching a buyer at 15-19.9%. |

Trading halt | +20.3% | +9.8% | STRONG - Often precedes a deal negotiation. |

New substantial holder | +15.7% | +12.6% | RELIABLE - Early entry before the crowd. |

Large Stake (>30%) | -22.8% | -22.8% | POOR - The "pop" has usually already happened. |

Quick note on the "20% threshold": In Australia, you generally can't buy more than 20% of a company without launching a formal takeover bid. Seeing someone park at 19.9% is the ultimate "ready to pounce" signal. Also, that +295% average vs +28% median is a huge gap it’s driven by a few massive "right-tail" winners where the stock sat near the limit for a long time before exploding.

Some case studies

MIXI/PointsBet (PBH)

PointsBet Holdings (PBH) was acquired by MIXI Australia in September 2025. While the initial automated score (the raw ranking the system gives a stock based on basic data volume) was low at 1/100, it triggered the most reliable pattern I have set up: Strategic Parking.

The system identified the entry of a strategic entity 15 months before the final takeover. People asked if the Easygo Entertainment entry was just random it’s actually very strategic. Easygo has deep ties to the gambling industry (connected to the Stake.com founders). Seeing them "park" a stake was the first signal that the sector was consolidating, eventually leading to the MIXI deal.

Date | Signal | What Happened |

May 31, 2024 | 🟢 STRATEGIC | Easygo Entertainment (Strategic) emerges at 5.01%. Parked for 9 months. |

Feb 25, 2025 | 🟡 SCHEME | Early Scheme interest detected. Score jumps to 11/100. |

July 17, 2025 | 🔴 STRATEGIC | MIXI Australia officially emerges at 9.15%. |

July 29, 2025 | 🔴 THRESHOLD | MIXI crosses 20% limit. |

Aug 28, 2025 | 🔴 ACCUMULATION | MIXI reaches 47.3% (The "Blitz": 38% bought in 6 weeks). |

Sep 15, 2025 | 🔴 CONTROL | MIXI establishes control at 66.4%. |

AHX (Apiam Animal Health)

Apiam was taken over by Adamantem Capital (PE). System score: 41/100.

Date | Signal | What Happened |

Mar 12, 2024 | 🟢 ACCUMULATION | Regal Funds increases to 11.19% (Early sector consolidation). |

Oct 9, 2024 | 🟡 NBIP REJECT | Apiam rejects NBIP. Signals the company is "in play." |

Aug 17, 2025 | 🔴 NEAR THRESHOLD | Adamantem Capital (PE) emerges at 19.9%. |

Oct 21, 2025 | ✅ SCHEME | Scheme Implementation Deed signed. |

Lead time: ~19 months from first signal. The NBIP rejection was the "dinner bell" that signaled a deal was coming 12 months before it was signed.

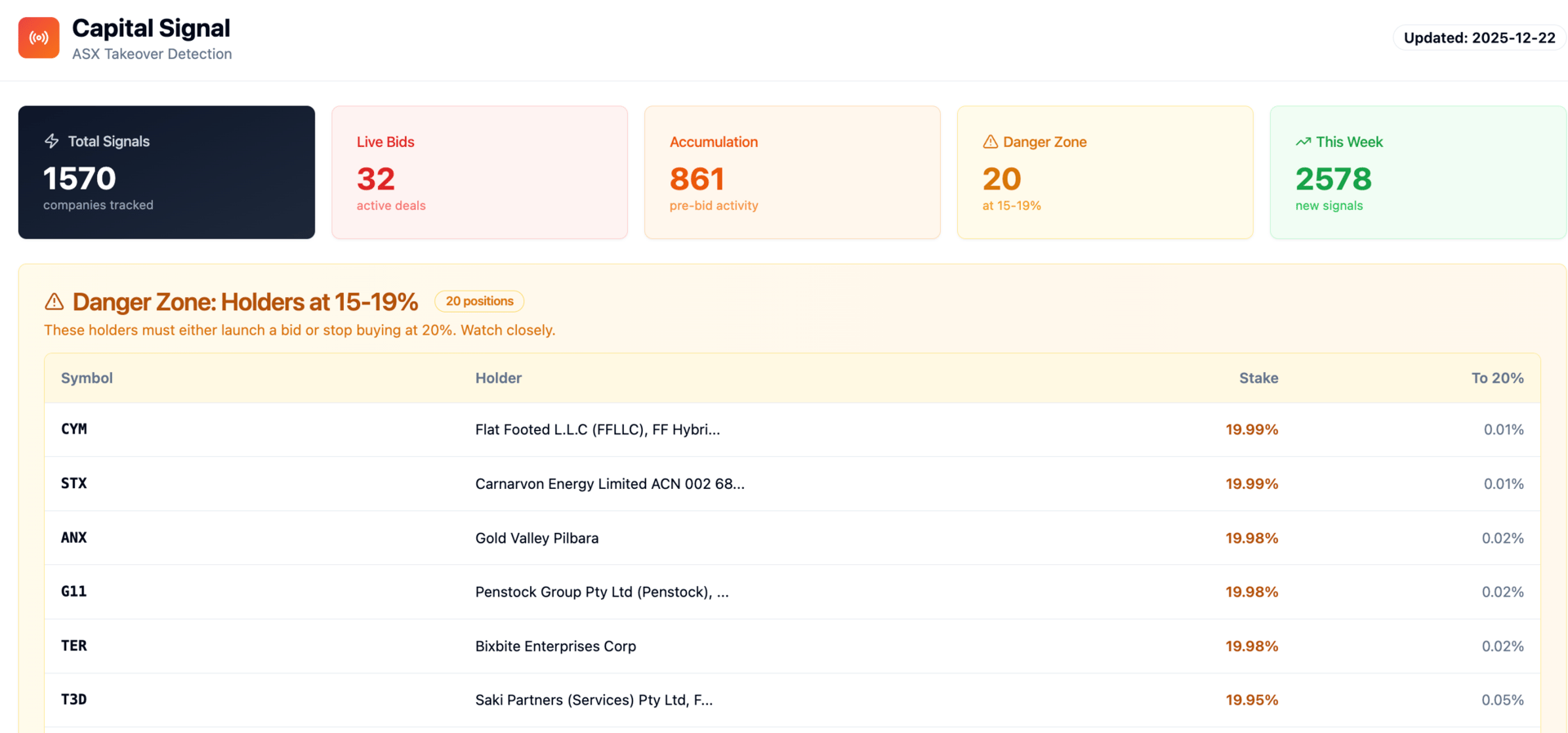

This Week's Watchlist

Based on the "Alpha Profile" (MBD + Strategic Accumulation), here is what the system is flagging right now:

PDI: Predictive Discovery ($1.86B Market Cap)

Who's accumulating: Perseus Mining (PRU) at 19.9% (NEAR THRESHOLD).

Multi board directors: Four directors with 6 other board seats in the Materials sector.

What to watch: Perseus is a $3B+ gold producer. Parking a 19.9% stake is the classic "Strategic Accumulation" pattern.

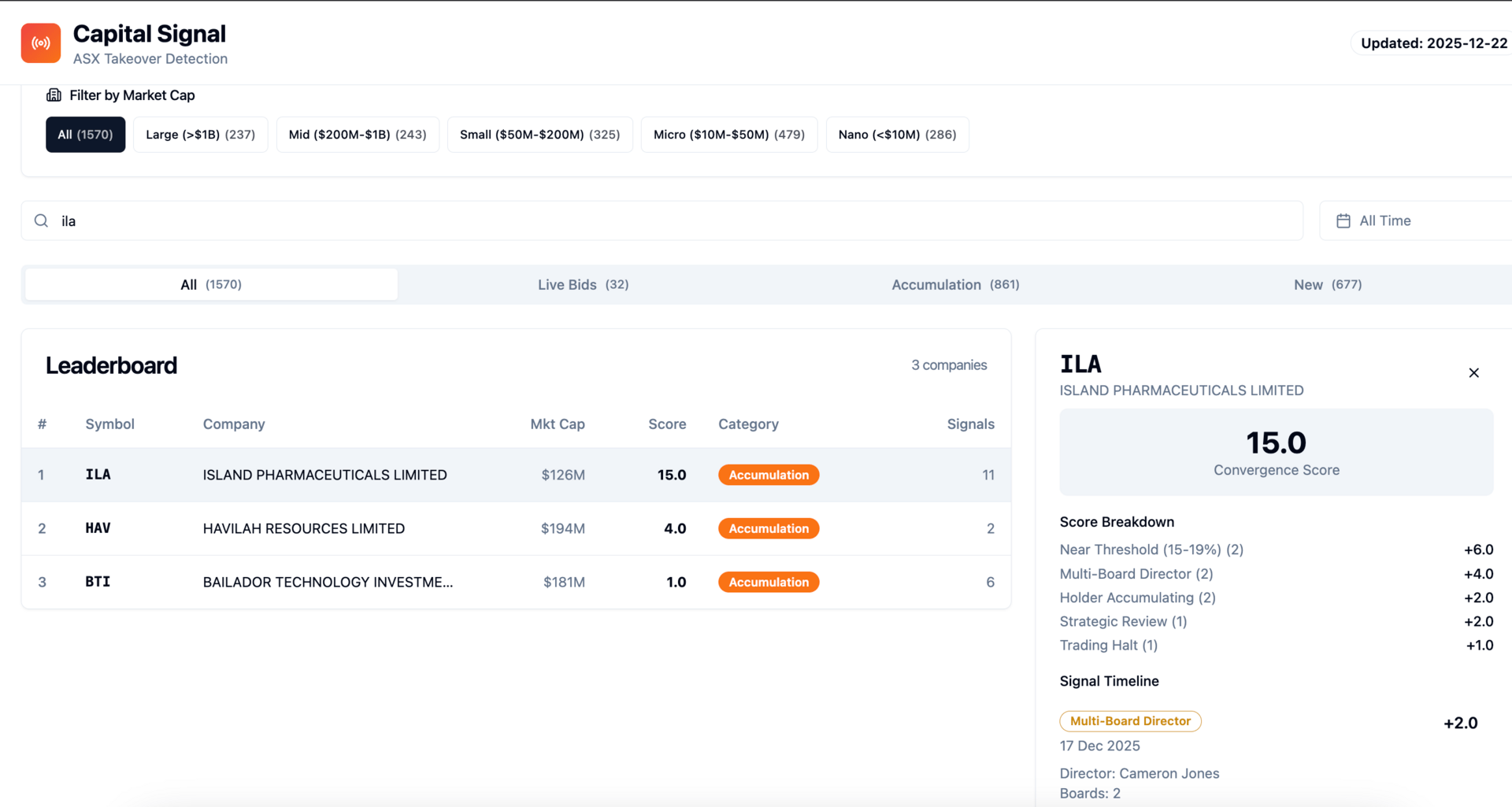

ILA: Island Pharmaceuticals ($126M Market Cap)

Who's accumulating: Dr. William James Garner at 15.5%; recent buying by Daniel Tillett.

Multi board directors: Multiple board connections to HMD and TRI.

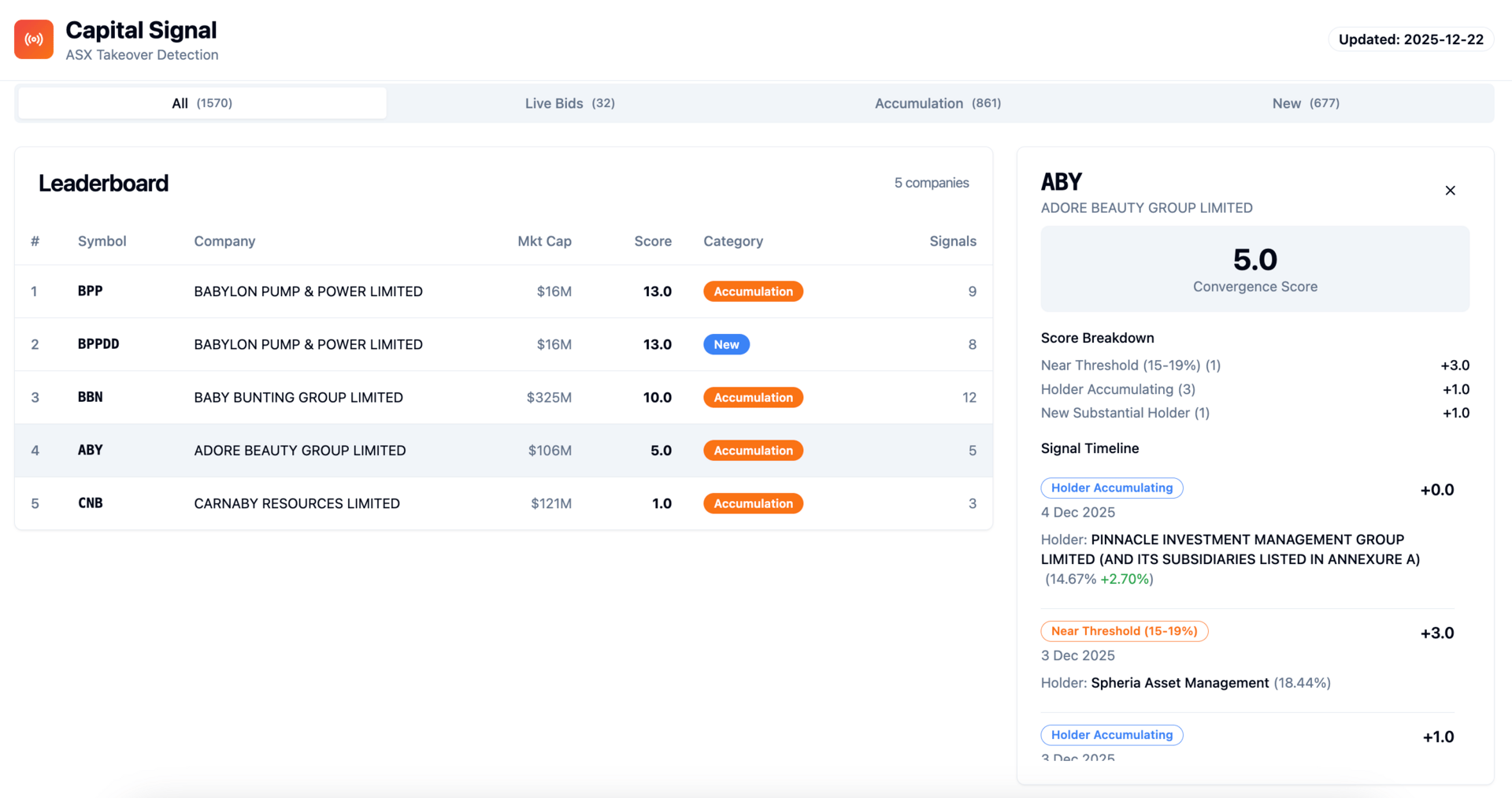

ABY: Adore Beauty ($105M Market Cap)

Who's accumulating: Spheria Asset Management at 18.44% (NEAR THRESHOLD).

What to watch: The 18.44% stake by Spheria is a major "dinner bell" for a potential bid.

W2V: Way2VAT ($21M Market Cap)

Who's accumulating: Thorney Technologies (Alex Waislitz) increased to 11.17%.

How the Scoring Works

I use multipliers to weigh signals:

STRATEGIC holders: 2x weight

MULTI-BOARD directors: 1.5x weight

PASSIVE holders (index funds): 0.1x weight

Here is a screen of our current tracker as a bonus

Coming Up

I'm building toward a tool with real-time alerts, search and frankly whatever else people find interesting. For now, this weekly newsletter is the channel.

Questions? Reply to this email or send me a message on X/Twitter or Linkedin. If you have a signal you think would be interesting to explore let me know and I’ll check it out.

Cheers

Damon

Disclaimer: This newsletter is for informational purposes only. The "Capital Signal" system is experimental and not a guarantee of future performance. Always consult a financial advisor before investing. The author may hold positions in the companies mentioned.