Good morning.

To continue the analysis of what makes up “good” companies (anything that has done a 300% in the last three years) I am going to begin with general metrics like P/S, EV/Revenue, Revenue Growth, Market Cap across the tags and market cap.

This will allow us to answer

Do most of these mutlibaggers make it from steady growth or catalyst events?

Is there a single factor that predicts success across all companies?

Do different metrics affect our segmentations differently?

The largest metric across all general metrics was company size which intuitively makes sense (its easier for a $30M company to become a $300M than $300M to $3B). However this is only a moderate correlation.

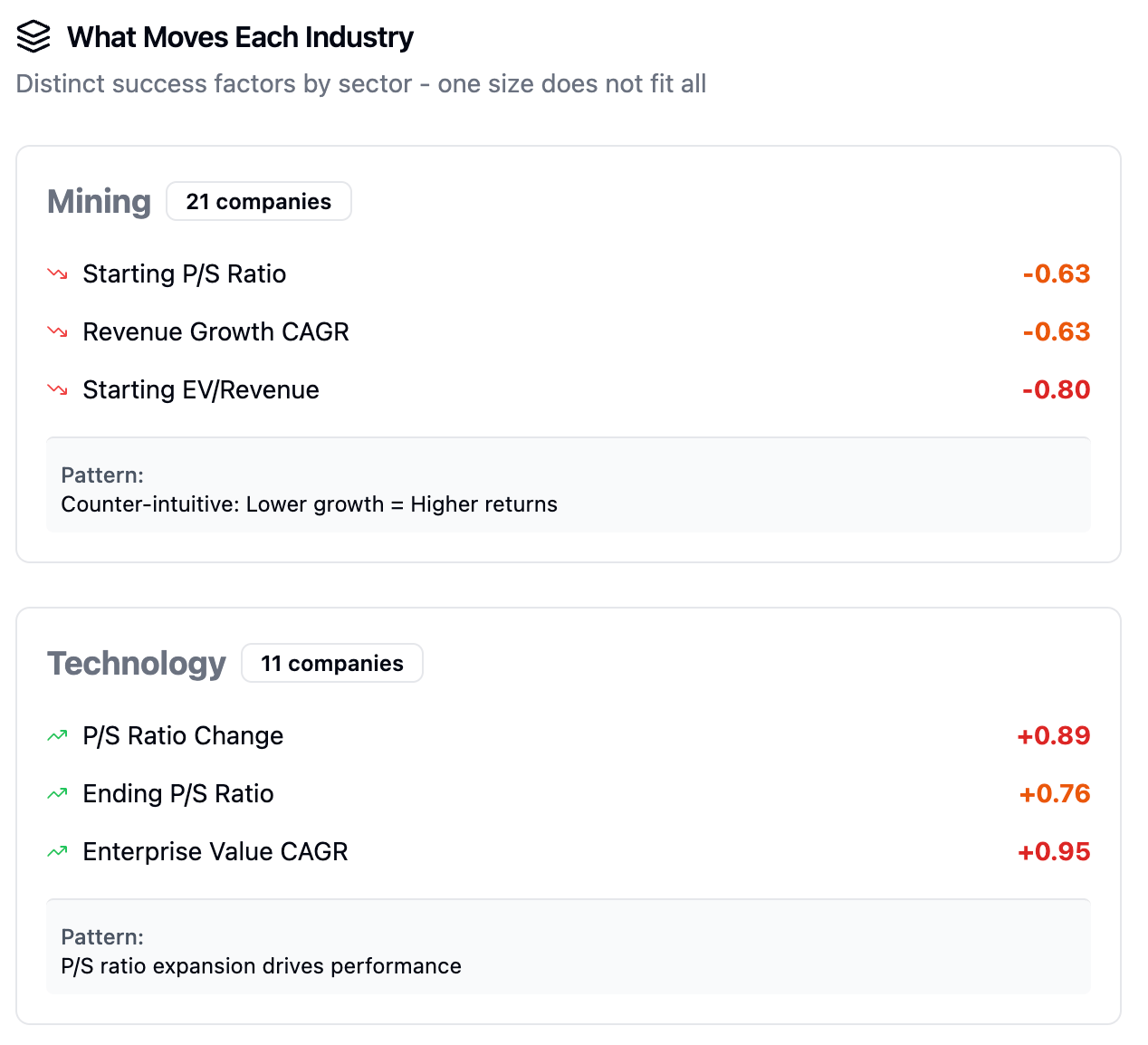

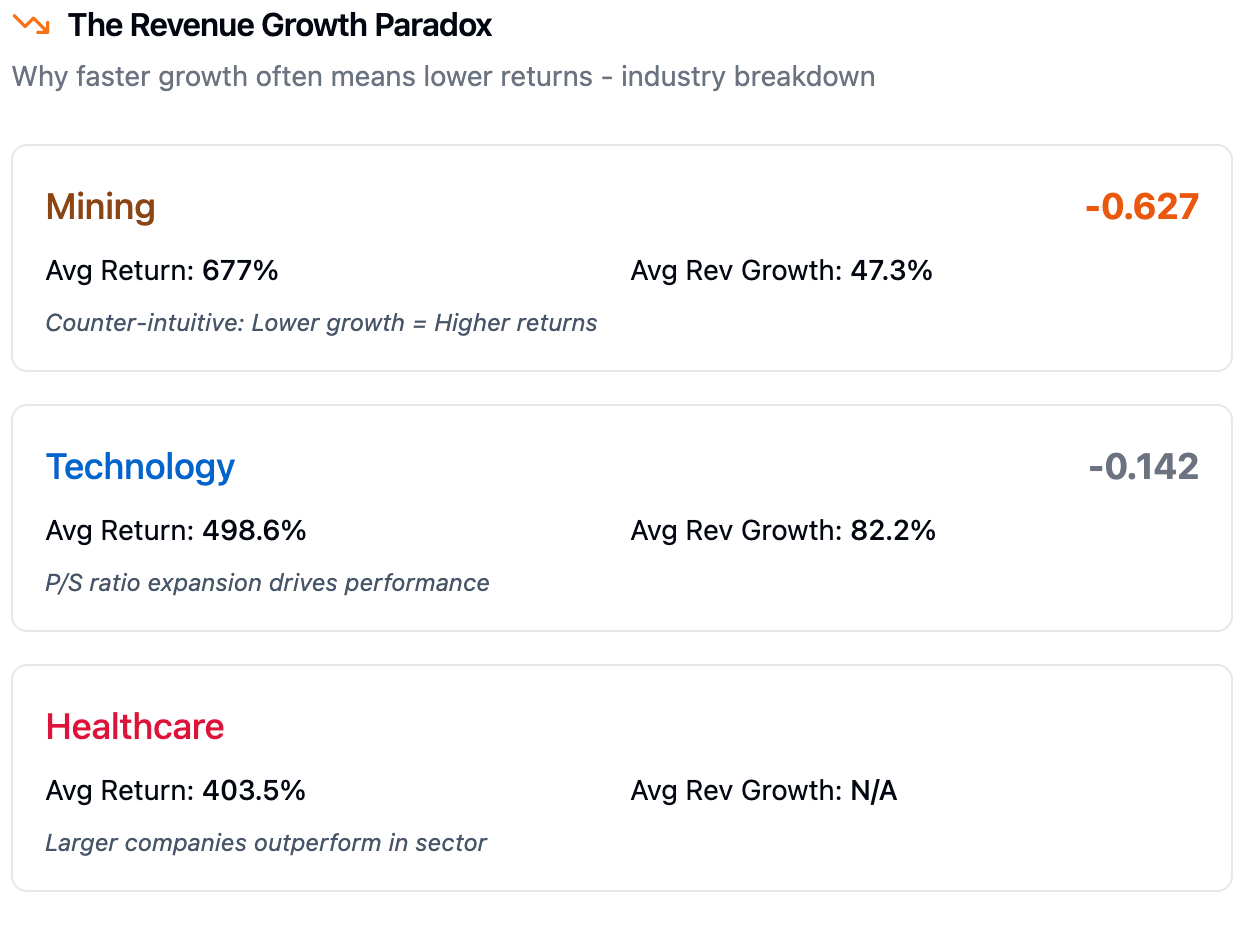

Across the different sectors we start to see a story play out with some strong correlations.

What we find is that within the Mining sector it actually matters less if you are making sales. I suppose this tracks with the broad makeup of winners within mining being more speculative plays as opposed to Tech where the key defining factor is fundamentally expansion and aggressively dominating a niche.

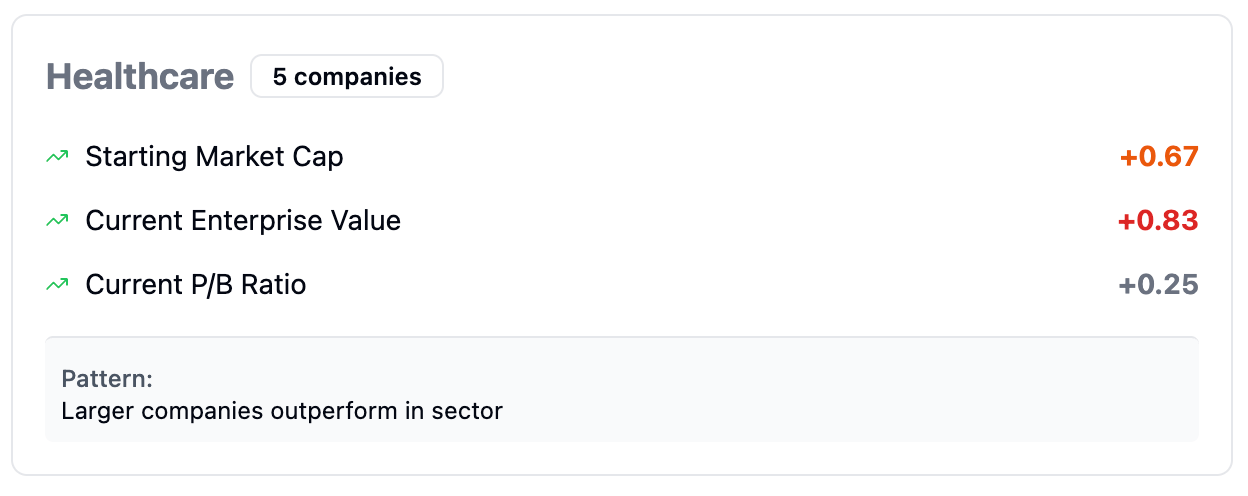

Within healthcare we have a deviation as well where the better performing companies tend to be larger, and be more correlated with a starting enterprise value than anything else. Perhaps achieving a moat is one of the driving factors.

Looking across the different metrics I also found that P/S and EV/Rev does not really matter.

Another strange fact here is that revenue growth was not correlated or only weakly correlated with higher returns. The only real metric to consider for tech was the P/S ratio.

So what did we learn?

With a general analysis (which I would like to caveat is only scratching the surface).

The majority of gains are in finding high quality small caps

Tech is about achieving distribution and product market fit (as a founder/ software engineer this always hits home). The key here is new shiny tech can be enticing but its always about the ability to solve a problem and get it in the hands of customers.

Mining multi baggers are primarily speculative (in the small cap space).

From here there is much more to look at. Next up I’ll be analyzing the balance sheets, cash flow and income statements across the same segments. After that I consider a lot of the low hanging fruit done we can look at management effectiveness. Some strategies I’m considering for this is:

Does management experience matter? (years in the field).

Did they move up the ranks? its all well and good being in a field for 10 years but if you stayed relatively stagnant and then made it on to a management position does that tell us something about your effectiveness?

Does connectedness matter? Is management connected with many other people in the field

I may reach the limit of what I can actually get data wise but we will see.

If you’re interested in the underlying data get in touch and I’ll share it.

Here are the market updates for Friday.

Profit Guidance Updates

$2.03M NPAT

Market Cap: $13.83M 0.0% ●

Growth: +247% YoY

Volume Interest: 1.52x (above average)

Major Capital Raisings

$100.0M

Market Cap: $1.33B -2.13% ●

Premium/Discount: 9.4% discount to VWAP

Volume Interest: 0.48x (low)

$20.0M

Market Cap: $111.9M -4.55% ●

Premium/Discount: 9.5% discount to market

Volume Interest: 0.55x (normal)

$4.0M

Market Cap: $12.3M 0.0% ●

Structure: 80m shares + 1:2 attaching options

Volume Interest: 0.85x (normal)

Up to $2.65M

Market Cap: $8.5M +1.41% ●

Premium/Discount: 25-30% discount

Structure: 1:3 rights + 1:1 options

Up to $1.33M

Market Cap: $4.9M -13.64% ●

Volume Interest: 1.78x (above avg)

Notable: Strongest negative reaction (-13.64%)

Up to $1.45M

Market Cap: $4.7M -7.14% ●

Volume Interest: 1.63x (above avg)

Structure: 2:5 rights + 1:2 options

Strategic Investments & Smaller Rounds

$0.15M

Market Cap: $6.3M 0.0% ●

Shortfall: $823k remaining (deadline 17 Sep)

Volume Interest: 0.25x (low)

Multiple Issues

Market Cap: $4.0M 0.0% ●

Investors: 6466 Investments, Taylor Collison

Volume Interest: 0.10x (very low)

$0.23M (placement)

Market Cap: $2.3M 0.0% ●

Volume Interest: 1.20x (above avg)

Status: $233k placement announced

$0.07M

Market Cap: $9.2M 0.0% ●

Volume Interest: 0.74x (normal)

Status: Discussions for remaining shortfall

Mining dominated (90%) with average -2.64% price reaction | All offerings at discount