In addition to the news today I want share that I’ll be embarking on a mission to try and define what the broad make up of a “good” company is.

Behind the scenes I’ve been analyzing companies by hand doing good old fashioned financial analysis from years prior.

Diving into announcements to grab the appropriate figures is absolutely as painful as I remember it being. The end goal of going back to grass roots analysis was to see where systems can be built for

1. the automated extraction of this data to tell the story of the company

2. the summed analysis of every company to tell the story of the sector.

My thinking was primarily if you can identify all key characteristics of what success looks like in this current climate than building additional tools to keep a scan on the market and track companies that meet these conditions will be much easier, or where they fall off from these conditions.

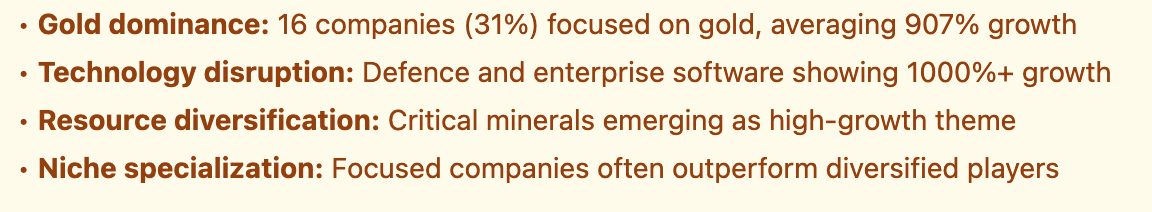

To begin I’ll be starting with every company that has done at least 300% in the last 3 years. I plan on taking additional snap shots to see companies that rallied in more challenging climates. Lucky for us we have recent accessible data from a constrained liquidity environment which will be useful for seeing where capital goes to replicate when money is short.

I should also note that these updates will be some what sporadic and be posted as I uncover something new. I will likely be posting these on my Linkedin or X (Twitter) accounts.

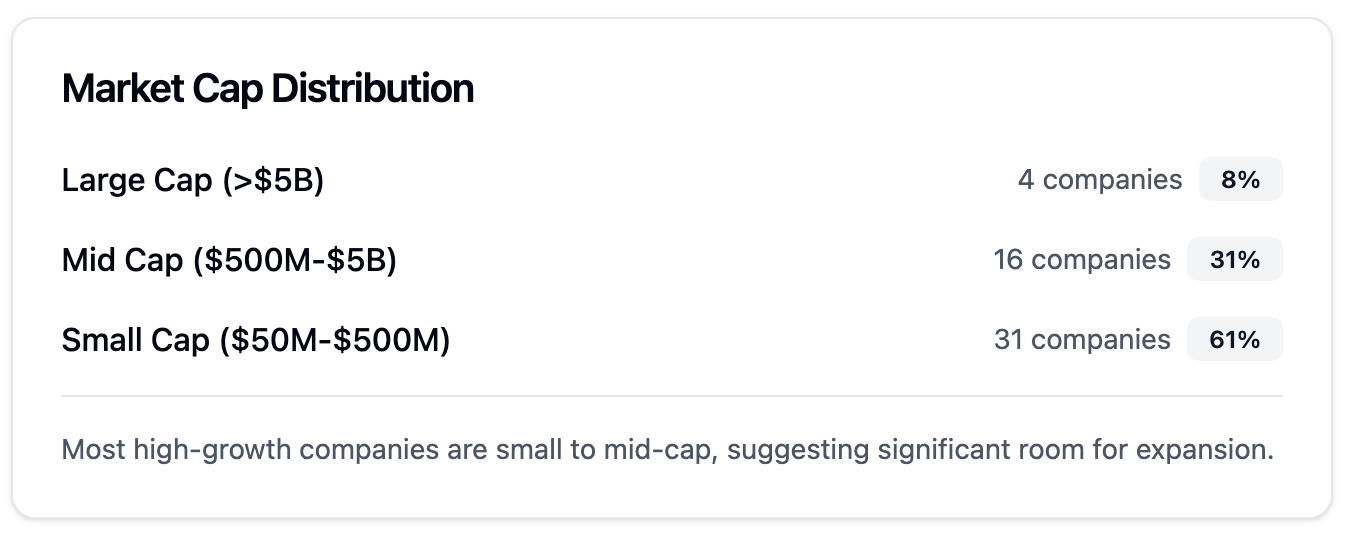

I Identified 59 companies that have rallied more than 300% in the last 3 years. Some of these were nano caps and the price movements were irrelevant so I excluded them from the analysis bringing us to 51 companies (the condition being they must have at least a 40m market cap now).

Here are some of the stats

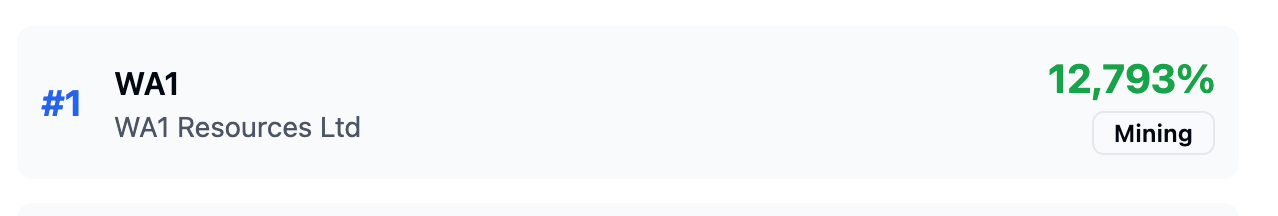

Sitting on top of the leaderboard is WA1 with some other usual suspects (DRO, SKS, ASL).

The distribution shows that there are plenty of multi baggers to be found in the small cap range.

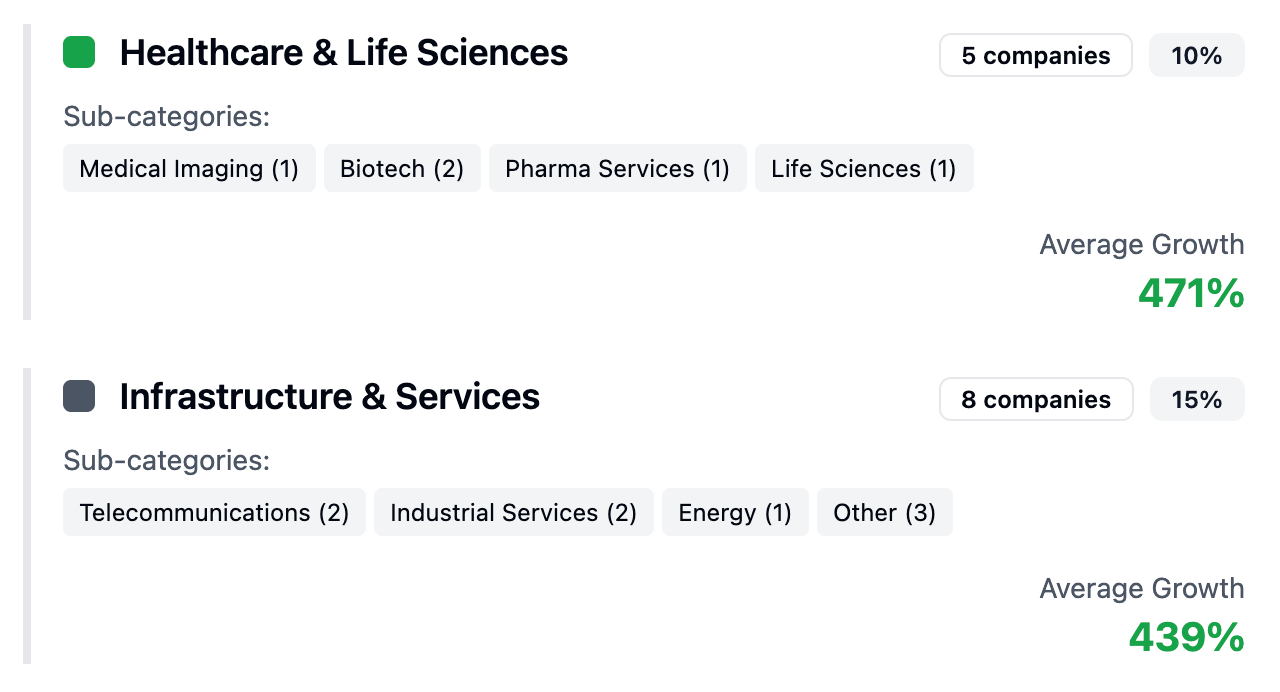

From my tagged database of ASX companies we can dive in a little further and see what exactly high growth ASX companies are doing.

Funnily enough mining gold remains as good an idea as it was long ago.

So this is a broad brush analysis of what is comprising a multibagger in the current environment. In the coming days/weeks I’ll look further into the make up of these companies and see what we can find in terms of their operations.

And without further ado here are the deals and guidance from yesterday.

Profit Guidance Updates

$1.92–2.22B EBITDA

Market Cap: $6.88B +1.79% ● Vol: 1.67x avg

FY25 EBITDA: $2,010M

Change: Neutral outlook amid pricing headwinds

“This result continues the recovery in AGL’s earnings and lays a solid foundation for the continued strategic investment in growth and the transition of AGL’s business.” – Damien Nicks, CEO

$192.0M EBITA

Market Cap: $1.25B +2.34% ● Vol: 0.96x avg

FY24 EBITA: $194.6M

Change: Slight decline offset by operational efficiency

“Solid result delivered in challenging environment leveraging AOV’s strong market positions and disciplined cost management.” – Management

~$46M EBIT

Market Cap: $204.8M -6.06% ● Vol: 1.29x avg

Previous: ~$41M (pre-restatement)

Change: $5.2M EBIT uplift from Chile revenue reallocation

“While we do not anticipate [this error] to materially affect our overall financial position, we are undertaking an immediate review of our processes and controls... to mitigate against any future errors.” – Sy Van Dyk, CEO

Major Capital Raisings

$30.0M

Market Cap: $255.0M +10.67% ● Vol: 1.86x avg

Lead Investors: High-quality offshore institutions

Use of Funds: Accelerate drilling at Glenburgh (Icon & Zone 126)

“This is a transformational capital raising for Benz which will position the Company to significantly increase its exploration activities.” – Management

$30.0M

Market Cap: $147.1M -8.03% ● Vol: 1.47x avg

Premium: 7.1% to 5-day VWAP

Lead Manager: Bell Potter Securities

Use of Funds: Spur Gold Corridor drilling & metallurgy

“I am delighted to announce this strategic placement, which was strongly supported by existing and new institutional investors.” – Management

Share Purchase Plans & Entitlements

$8.27M

Market Cap: $167.1M -1.09% ● Vol: 0.08x avg

Take-up: 414% oversubscribed

Issue Price: $0.81/share

“We are extremely pleased by the level of support we have received from our existing shareholders.” – Management

Up to $3.0M

Market Cap: $251.4M 0.0% ● Vol: 0.76x avg

Discount: 16.3% to 5-day VWAP

Status: Not yet completed

Up to $5.75M

Market Cap: $12.5M +2.5% ● Vol: 0.62x avg

Issue Price: $0.035/share

Up to $2.57M

Market Cap: $3.17M +5.0% ● Vol: 0.17x avg

Underwritten: Yes (Anadara Asset Management)

Use of Funds: Aggressive drilling at Blue Devil & Mt Boggola

Smaller Raises & Strategic Placements

US$15M (~A$23M)

Market Cap: $197.2M +1.02% ● Vol: 0.94x avg

Lead Manager: MST Financial

Use of Funds: Acute wound portfolio development

$416.6K

Market Cap: $14.2M -10.0% ● Vol: 0.95x avg

Use of Funds: Working capital

A$2.86M (target)

Market Cap: $3.59M 0.0% ● Vol: 0.26x avg

Status: Shareholder approval required

Use of Funds: Drilling at Triumph & Coonambula

$0.91M (placement)

Market Cap: $9.58M -4.55% ● Vol: 0.3x avg

Entitlement: 1-for-8 non-renounceable offer

Use of Funds: 8,500m drilling at Grace Project

Sector Mix: Mining (58%), Healthcare (16%), Tech (16%), Biotech (5%), Undeclared (5%)

Thanks for reading Capital Signal

14 August 2025 | Data sourced from ASX announcements