THE WEEKLY SIGNAL

ASX M&A & Takeovers | Week of December 22, 2025

Merry Christmas and happy holidays.

Whats new?

I have done further refining of the signal detection as well as much more aggressive backtesting to see the performance. I may elaborate on this in the next post but I was interested in getting this out and enjoying some sunshine still.

Coming up will be more investigation of behavior patterns of key players (funds and directors). Who is often involved in these deals, turn arounds etc etc.

It is of particular interest to build a full “map” of the directors, their experience and their past behavior as well. For example if they show up in different takeover notices or turn around stories and we can back test it that could be a very positive signal. Good people do after all tend to attract good things.

As always love to hear your ideas, thoughts and feedback.

Without further ado here is the news from the last week.

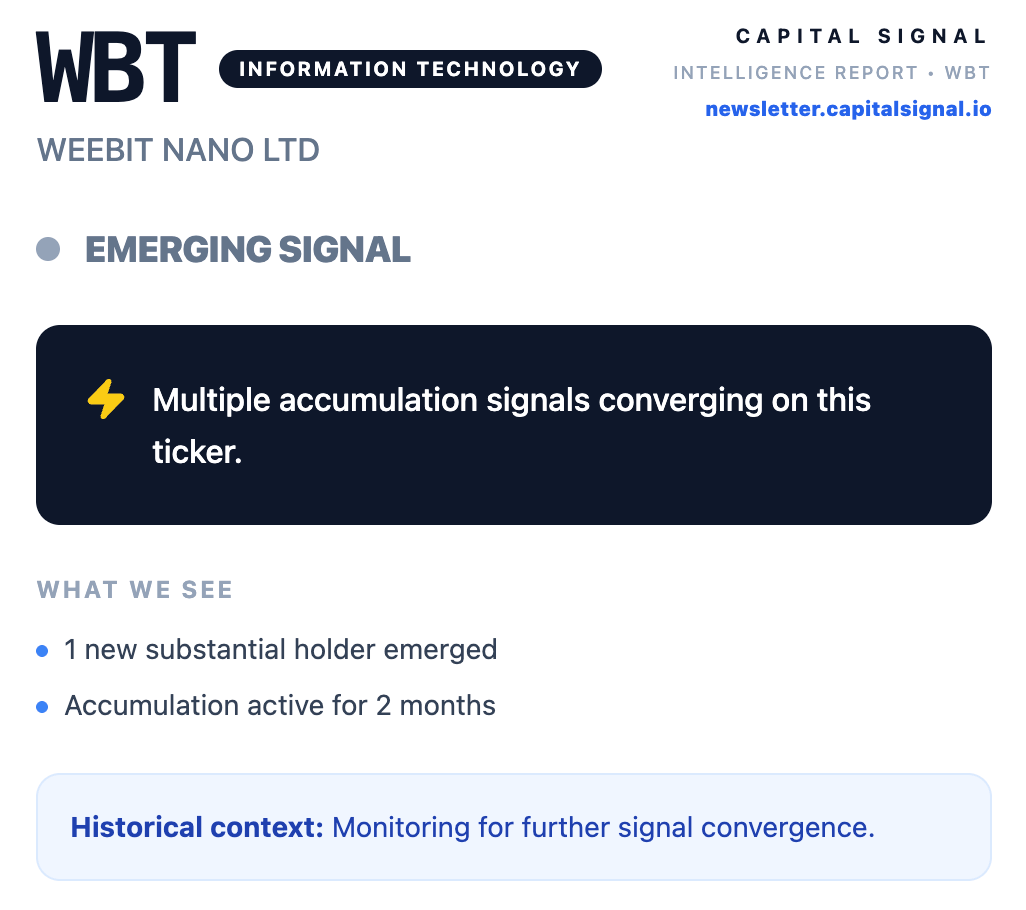

HEADLINE NEWS: WEEBIT NANO (WBT) SECURES TEXAS INSTRUMENTS DEAL

The biggest news from this week is Weebit Nano (WBT) securing a major license agreement with Texas Instruments (TI). This appears to be validation for WBT's ReRAM technology, moving it from "speculative tech" to "tier-1 validated."

The Signal: This follows a period of heavy accumulation we've tracked in the semiconductor space. When a global giant like TI signs a license deal, it often precedes a deeper strategic partnership or an outright acquisition of the IP.

DANIEL TILLETT ENTERS TRIVARX (TRI)

High-conviction biotech investor Dr. Daniel Tillett has officially crossed the 5% substantial threshold in Trivarx (TRI), taking a 5.42% stake.

Why this matters: Tillett has a legendary track record of identifying distressed biotech assets and driving massive turnarounds (most notably Race Oncology). His entry into TRI a micro-cap focused on mental health diagnostics is the clearest "conviction signal" in the sector this month.

THE RMI DEBT-TO-EQUITY HANDOVER

We've been tracking a "Dual Blocking Stake" in Resource Minerals (RMI).

Chairman Asimwe Kabunga has been reducing his direct equity (now 19.0%), while VEN Capital has aggressively built to 19.9%.

The Context: VEN Capital is not a hostile bidder; they are a primary lender to RMI.

The Analysis: While not a takeover battle it is a balance sheet restructuring. VEN is maxing out their equity position, likely as part of a debt-to-equity conversion or a strategic handover from the Chairman. This "cleans up" the register for the next phase of the company's growth.

THE 19.9% CEILING: STRATEGIC ACCUMULATION

When a holder hits above 20% they must make a formal takeover bid. Here is who is approaching the limits.

Symbol | Holder | Stake | Market Cap | Role |

|---|---|---|---|---|

SB2 | Wilson Asset Management | 19.81% | Micro (<$50m) | Activist Catalyst |

BAP | Tanarra Capital | 15.70% | Mid ($100-500m) | Strategic Player |

CCX | Spheria Asset Management | 19.60% | Micro (<$50m) | Value Catalyst |

SB2 (Salter Brothers): Wilson Asset Management (WAM) has hit 19.81%. WAM is a specialist in closing NTA discounts. By parking at the 19.9% limit, they can effectively forced the board's hand on capital management.

BAP (Bapcor): Tanarra Capital continues to creep, now at 15.7%. Unlike passive funds, Tanarra (led by John Wylie) is known for operational intervention. Their steady accumulation can also suggest a push for a board-led restructuring is imminent.

BOARD SHAKEUPS & EXITS

Blackstone Minerals (BSX): The Managing Director has resigned amid a broader board transition.

Swoop (SWP): A major substantial holder has exited the register today. Watch for who picked up the block as large off-market transfers can often precede a change in control.

Our backtesting of 101 unique strategic entries (PE, Activists, and Corporate Bidders) showed a significant "Strategic Premium" in both lead time and conversion.

Metric | Market Average | Strategic Entry |

|---|---|---|

Conversion to Deal | ~5% | 33.7% |

Mean Lead Time | 249 days | 402 days |

Median Lead Time | 224 days | 385 days |

The Proof:

1 in 3 strategic entries in our database has resulted in a formal takeover bid or scheme.

Successful Conversions: We've tracked successful exits in SXL (Southern Cross Media), ORA (Orora), and MCE (Matrix Composites) following strategic accumulation.

The "In Play" List: Current stocks with active strategic holders but no bid yet include SIQ (Smartgroup), MDR (Medusa Mining), and WPR (Waypoint REIT).

The Lesson: What we have found through backesting as these entities have a similar behavior patter. These trades don’t unfold over the next week however. A strategic entry in our backtesting showed it took around 12-18 month signal, but with a 6x higher probability of a deal than a random stock on the ASX.

WHATS ON THE WATCHLIST THIS WEEK

WBT (Weebit Nano): The Texas Instruments deal is a watershed moment. Watch for follow-on accumulation from institutional tech funds who were previously on the sidelines.

TRI (Trivarx): Daniel Tillett's entry usually precedes a board seat request or a capital raise. Watch the 4C quarterly reports for TRI's cash runway.

RMI (Resource Minerals): Now that VEN Capital has maxed out at 19.9%, watch for a formal debt-to-equity conversion announcement or a change in the Chairman's role.

BSX (Blackstone Minerals): MD resignation often precedes a "Strategic Review." Watch for any "Expression of Interest" announcements.

📈 BY THE NUMBERS

Metric | This Week |

|---|---|

Live bids/schemes | 33 |

New substantial holders (this week) | 12 |

Holders near threshold (15-19.9%) | 1,051 |

High-conviction "Smart Money" entries | 3 (WBT, TRI, BAP) |

Questions? Reply to this email or send me a message on X/Twitter or Linkedin. If you have a signal you think would be interesting to explore let me know and I’ll check it out.

Cheers

Damon

This is not financial advice. Do your own research.