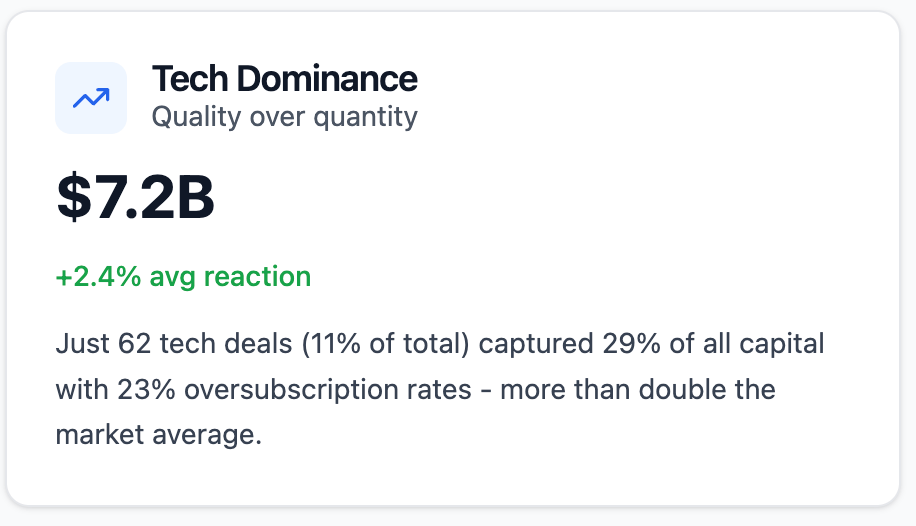

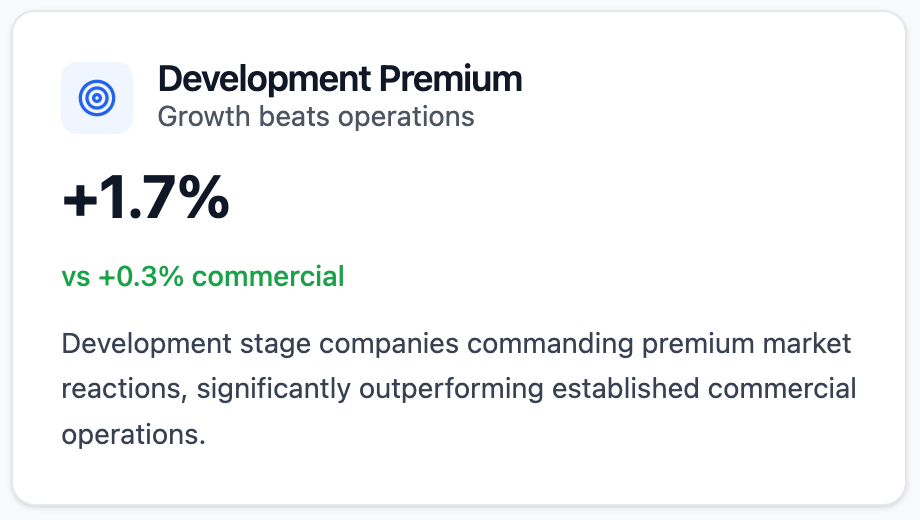

In addition to yesterdays capital activity I have built a leaderboard to get a better idea of what is happening structurally in terms of ASX deals.

The microstructure of the market is some what more revealed when you dive in to the data.

Some additional points

across all deals over the last month only 10% were oversubscribed

of 10 guidance updates 40% were posting upgrades

We’ll be diving deeper into these insights and including them as we find out more. If you’ve got any ideas for the leaderboard feel free to fire an email back or connect with me on Linkedin and share your thoughts.

August 7, 2025

📊 A$78+ million raised across 13+ deals | 3 sectors | Market sentiment: Mixed | Price reactions: -8.0% to +33.3%

Major Capital Raisings

Syrah Resources (SYR)

Entitlement + Placement

A$70.0M Target (A$42M completed)

Market Cap: A$317.9M +3.39% ●

A$70.0M Target (A$42M completed)

Market Cap: A$317.9M +3.39% ●

Issue Price: A$0.26 per share

Structure: Fully underwritten, 1 for 5.42 pro rata

Status: Institutional component completed, retail opens Aug 6

Structure: Fully underwritten, 1 for 5.42 pro rata

Status: Institutional component completed, retail opens Aug 6

Standout Metric: Large scale dual offer structure with institutional backing

FBR Limited (FBR)

Share Subscription Facility

A$20.0M Facility

Market Cap: A$34.1M 0.0% ●

A$20.0M Facility

Market Cap: A$34.1M 0.0% ●

Partner: GEM Global Yield LLC SCS

Advisor: Peak Asset Management

Terms: 3-year facility, discretionary drawdowns

Advisor: Peak Asset Management

Terms: 3-year facility, discretionary drawdowns

Use of Funds: Growth strategy, R&D, commercialization

Key Metric: Flexible 3-year facility for strategic growth initiatives

Lindian Resources (LIN)

Strategic Partnership

US$20M + Offtake

Market Cap: A$111.2M -6.0% ●

US$20M + Offtake

Market Cap: A$111.2M -6.0% ●

Strategic Partner: Iluka Resources

Structure: US$20M construction loan + 15-year offtake agreement

Terms: 5-year loan term

Structure: US$20M construction loan + 15-year offtake agreement

Terms: 5-year loan term

Standout Metric: Combined debt facility with long-term offtake provides project certainty

Strategic Investments & Smaller Rounds

Patrys Limited (PAB)

Entitlement Offer

A$1.77M

Market Cap: A$4.7M +33.33% ●

A$1.77M

Market Cap: A$4.7M +33.33% ●

Underwriter: Templar Corporate Pty Ltd

Issue Price: A$0.001 per share

Structure: 3 for 4 + 1 free attaching share

Issue Price: A$0.001 per share

Structure: 3 for 4 + 1 free attaching share

Use of Funds: Technical work, IP portfolio, business development

Key Metric: Includes free attaching shares, strongest price reaction at +33.33%

Manhattan Corporation (MHC)

Completed

A$2.2M

Market Cap: A$10.3M -8.0% ●

A$2.2M

Market Cap: A$10.3M -8.0% ●

Issue Price: A$0.02 per share

Status: Completed August 6, 2025

Status: Completed August 6, 2025

Use of Funds: Hook Lake Project advancement

Corazon Mining (CZN)

Placement + M&A

A$2.0M

Market Cap: A$3.0M 0.0% ●

A$2.0M

Market Cap: A$3.0M 0.0% ●

Issue Price: A$0.002 per share

Status: Firm commitments received, subject to shareholder approval

Asset Acquisition: Two Pools Gold Project from Mining Equities Pty Ltd

Status: Firm commitments received, subject to shareholder approval

Asset Acquisition: Two Pools Gold Project from Mining Equities Pty Ltd

Use of Funds: Two Pools Gold Project exploration, working capital

Additional Activity

Kingfisher Mining (KFM)

A$1.33M entitlement issue

Copper, Gold | +1.3%

A$1.33M entitlement issue

Copper, Gold | +1.3%

BMG Resources (BMG)

A$0.6M placement

Mineral exploration | 0.0%

A$0.6M placement

Mineral exploration | 0.0%

Thanks for reading Capital Signal!