Happy Friday.

I’ve been analyzing deal flow over the last month and its beginning to tell quite the story.

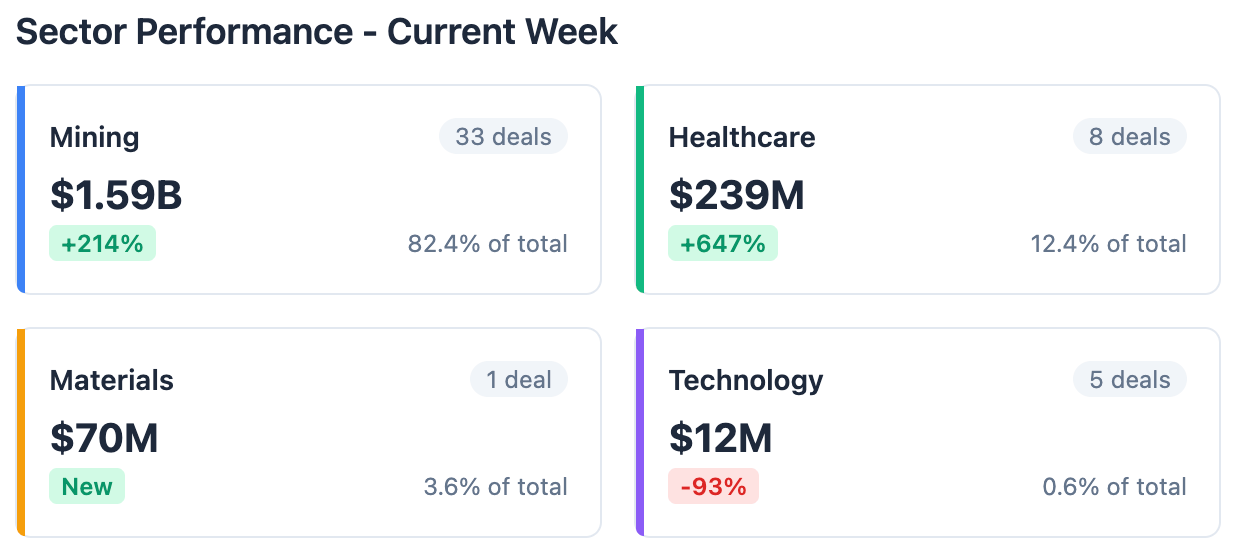

There was ~$1.93 Billion raised in the across 53 deals this week. July vs June shows signs that many are feeling that capital raising seems to be heating up as volume increased by 10%.

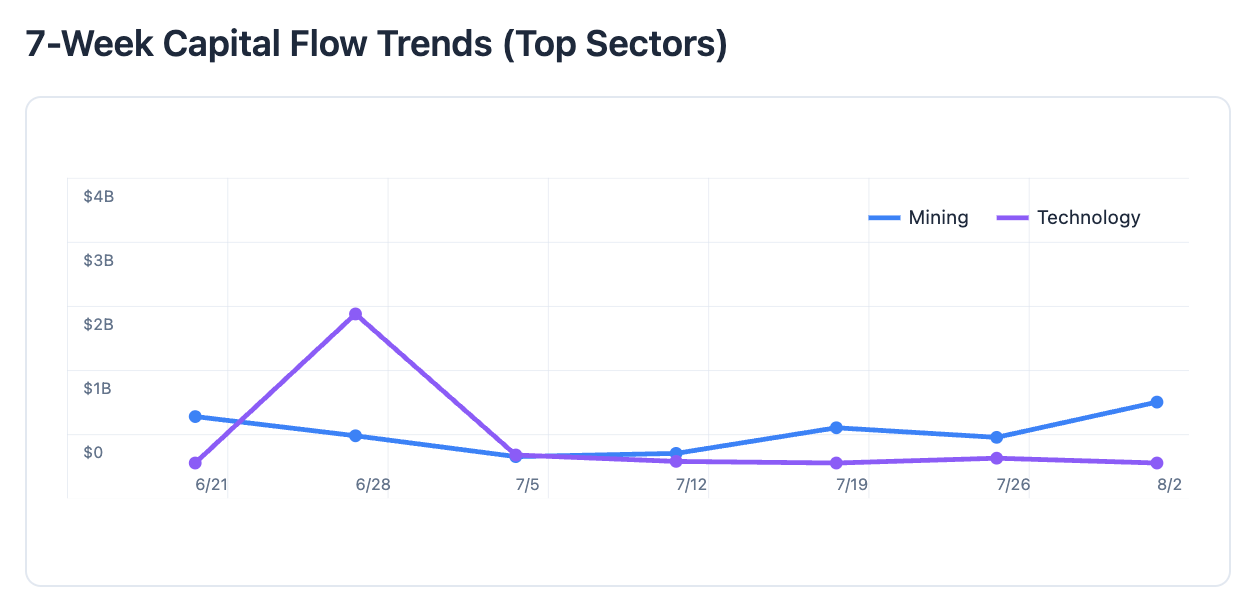

While tech has largely stayed flat (outside of the XRO raise) mining is increasingly heating up in volume. This has been seen across the market with some sectors entering into a bull market while others continuing a sluggish patter.

So from this week compared to last mining and healthcare increasingly are dominating and heating up while tech is remaining flat (it should be noted that the 93% decrease is mainly from the big capital raise XRO did).

Anyway without further ado lets get into what happened yesterday.

ASX Capital Signal

August 1, 2025

Profit Guidance Updates

Major Capital Raisings

$10.0M

Market Cap: $111.7M +2.13% ●

Structure: Hybrid debt and equity loan

Key Terms: Non-dilutive if share price rangebound, distribution option for Pro Medicus

$9.8M

Market Cap: $36.2M +6.82% ●

SPP: $6.9M from existing shareholders

Issue Price: $0.04 per share

$6.1M

Market Cap: $51.8M -2.78% ●

Issue Price: $0.065 (8.5% discount)

Structure: Two tranches, Directors participating

$5.5M

Market Cap: $15.5M -8.0% ●

Issue Price: $0.015 per share

Major Participation: Holdmark Property Group ($1.25M), Chairman ($0.35M)

Strategic Investments & Smaller Rounds

$4.3M

Market Cap: $19.6M +10.0% ●

Issue Price: $0.085 (2.98% discount)

Geography: South Dakota lithium projects

$4.5M

Market Cap: $16.2M -14.29% ●

Issue Price: $0.005

Free Options: 1-for-2 attaching options

$2.7M

Market Cap: $175.5M 0.0% ●

Take-up Rate: 88.57%

Issue Price: $0.017

$2.0M

Market Cap: $4.7M +16.67% ●

Issue Price: $0.005

Key Asset: Diamantina Copper-Gold Project acquisition

August 1, 2025